UNIT – 1 MEANING AND SCOPE OF ACCOUNTING

a) What is Accounting?

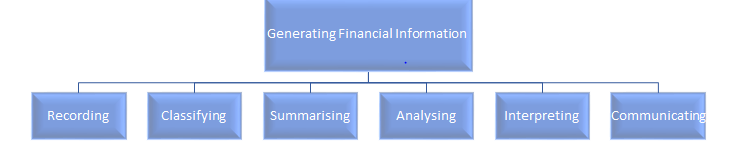

The American Institute of Certified Public Accountants (AICPA) defines accounting as: “the art of recording, classifying, and summarizing in a significant manner and in terms of money, transactions and events which are, in part at least of financial character, and interpreting the results thereof.

b) Procedural aspects of accounting

- Generating Financial information

- Using the financial information

c) Objectives of Accounting

- Systematic Recording of transaction

- Ascertainment of results of above recorded transactions

- Ascertainment of financial position of the business

- Providing information to the users for rational decision making

- To know solvency position

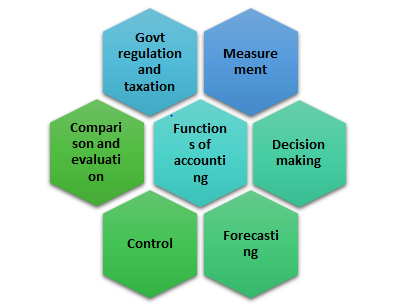

d) Functions of Accounting

e) What is Book Keeping?

Book – Keeping is an activity concerned with the recording of financial data relating to business operations in a significant and orderly manner. It covers procedural aspects of accounting work and embraces record keeping format.

f) Objectives of Book Keeping

- Complete recording of transaction

- Ascertainment of financial effect on the business

g) Book Keeping vs Accounting

| Bookkeeping | Accounting |

| Recording of Transaction | Summarising of recorded transactions |

| Base for accounting | Language of the business |

| Financial statements do not form part of this | Financial statements are prepared in this process |

| Managerial decisions cannot be taken | Management takes decisions on the basis of these records |

| No sub-field of book-keeping | It has several sub-fields like financial accounting, Management accounting etc |

| Financial position of the business cannot be ascertained | Financial position of the business is ascertained |

h) Sub Fields of Accounting:

- Financial Accounting

- Management Accounting

- Cost Accounting

- Social Responsibility Accounting

- Human Resource Accounting

i) Users of Accounting Information:

- Investors

- Employees

- Lenders

- Suppliers and Creditors

- Customers

- Government and their agencies

- Public

- Management

j) Areas of service:

- Taxation

- Consultancy Service

- Financial Advice

- Management Accounting

- Internal Audit

- Statutory Audit

- Other services (Secretarial, arbitration, liquidation..etc

- Maintenance of books of Accounts

k) Limitations of Accounting:

- The factors which may be relevant in assessing the worth of the enterprise don’t find place in the accounts as they cannot be measured in terms of money like loyalty and skill of personnel.

- Balance Sheet shows the position of the business on the day of its preparation and not on the future date while the users of the accounts are interested in.

- Accounting ignores changes in some money factors like inflation etc.

- There are occasions when accounting principles conflict with each other.

- Certain accounting estimates depend on the sheer personal judgement of the accountant, e.g., provision for doubtful debts.

- Financial statements consider those assets which can be expressed in monetary terms.

- Divergent accounting policies for the treatment of same item adds to the probability of manipulations.

Accounting is closely related with several other disciplines like accounting, Economic, statistics, management etc and thus to acquire a good knowledge in accounting one should be conversant with the relevant portions of such disciplines.